“Unveiling the S&P 1500 Zweig Breadth Thrust: Go Deeper Now!

As investors become increasingly concerned about the stock market environment, understanding the breadth of the market is essential. The Zweig Breadth Thrust and other indicators provide valuable insight into market sentiment and activity. In this article, we will be discussing the SP 1500 and charting the Zweig Breadth Thrust.

The S&P 1500 is a market-capitalization weighted index that tracks the performance of large and mid-cap stocks in the U.S. It tracks the performance of the largest 500 companies in the US—the S&P 500—as well as the S&P 400, S&P 600, and S&P 400 mid cap indices. This index provides insight into the overall direction of the U.S. stock market.

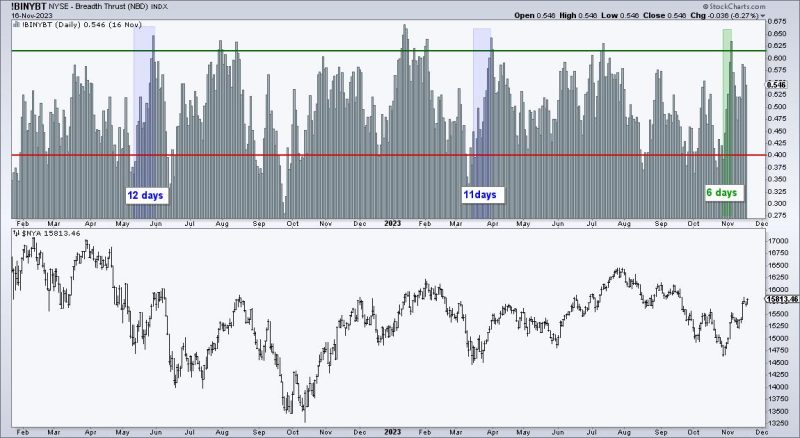

The Zweig Breadth Thrust measures the difference between the number of stocks making 52-week highs and those making 52-week lows. The higher the Zweig Breadth Thrust, the higher the market’s momentum. A high breadth thrust indicates that many stocks are making 52-week highs, while a low breadth thrust indicates that relatively few stocks are making 52-week lows.

Charting the Zweig Breadth Thrust is used to determine whether the stock market is in a state of accumulation or distribution. If the Zweig Breadth Thrust is rising, this indicates that money is flowing from weak stocks to strong stocks and is a sign of potential market strength. Conversely, if the Breadth Thrust is falling, then this indicates that money is flowing away from strong stocks and into weaker stocks—a sign of market weakness.

The Zweig Breadth Thrust is a valuable tool for investors and traders to gain insight into the current market sentiment. Charting the SP 1500 along with the Zweig Breadth Thrust allows for a more comprehensive view of the state of the market. By tracking the SP 1500 and the Breadth Thrust together, investors can assess whether the market is currently in an accumulation or distribution phase, and thus avoid potential trading losses.

As investors become increasingly concerned about the stock market environment, understanding the breadth of the market is essential. The Zweig Breadth Thrust and other indicators provide valuable insight into market sentiment and activity. In this article, we will be discussing the SP 1500 and charting the Zweig Breadth Thrust.

The S&P 1500 is a market-capitalization weighted index that tracks the performance of large and mid-cap stocks in the U.S. It tracks the performance of the largest 500 companies in the US—the S&P 500—as well as the S&P 400, S&P 600, and S&P 400 mid cap indices. This index provides insight into the overall direction of the U.S. stock market.

The Zweig Breadth Thrust measures the difference between the number of stocks making 52-week highs and those making 52-week lows. The higher the Zweig Breadth Thrust, the higher the market’s momentum. A high breadth thrust indicates that many stocks are making 52-week highs, while a low breadth thrust indicates that relatively few stocks are making 52-week lows.

Charting the Zweig Breadth Thrust is used to determine whether the stock market is in a state of accumulation or distribution. If the Zweig Breadth Thrust is rising, this indicates that money is flowing from weak stocks to strong stocks and is a sign of potential market strength. Conversely, if the Breadth Thrust is falling, then this indicates that money is flowing away from strong stocks and into weaker stocks—a sign of market weakness.

The Zweig Breadth Thrust is a valuable tool for investors and traders to gain insight into the current market sentiment. Charting the SP 1500 along with the Zweig Breadth Thrust allows for a more comprehensive view of the state of the market. By tracking the SP 1500 and the Breadth Thrust together, investors can assess whether the market is currently in an accumulation or distribution phase, and thus avoid potential trading losses.