“Don’t Worry – This Indicator Predicts ZERO Chance of a Market Crash!

For investors, trying to predict the future of the stock market can be a daunting task, as market conditions can shift dramatically in a matter of days. However, one indicator that has been closely watched by experts is pointing in the direction of stability.

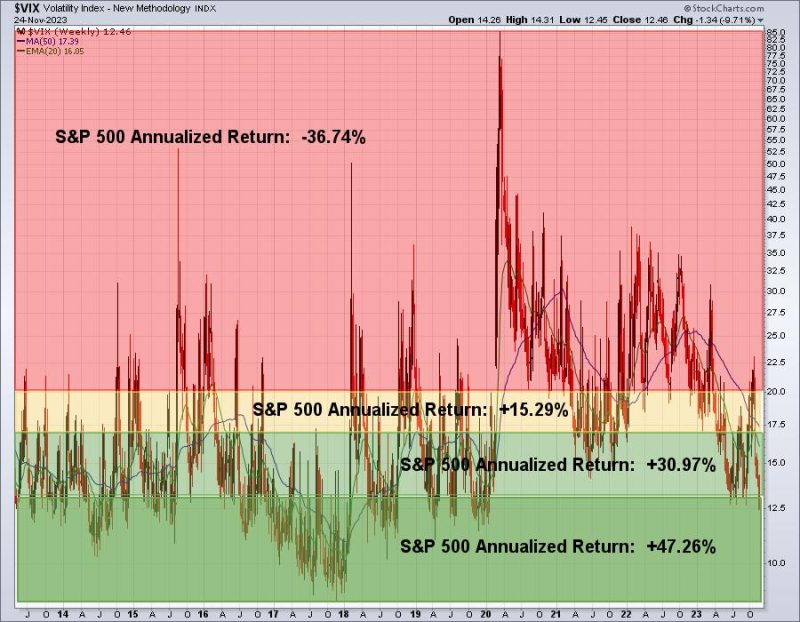

The Chicago Board Options Exchange (CBOE) Volatility Index, more commonly known as the VIX, is a measure of expected volatility in the markets. It is a widely accepted barometer of investor sentiment, with a high VIX signaling a more bearish outlook and a low VIX indicating a more bullish one.

Over the past year, the VIX has steadily declined. In fact, it has hit an all-time low in recent months, closing at 10.79 on April 9th. This indicator suggests that investors are expecting little to no volatility ahead, meaning a market crash is unlikely.

Furthermore, some economic data points also suggest that the markets are on firm ground. For instance, corporate earnings have been relatively strong, with the broad S&P 500 up 9.3% year-to-date. Unemployment is sitting at a historically low level of 3.5%, and consumer confidence is at an all-time high.

It’s also worth noting that while stocks have been on a tear this year, they have been relatively muted when compared to past bull markets. Indeed, the S&P 500 is up only 5% since the beginning of 2019, which is relatively low considering the index nearly doubled between 2013 and 2018.

With all of this information in mind, the chances of a market crash appear slim. Although it is impossible to predict the future with absolute certainty, the combination of low volatility and encouraging economic data suggest that investors should be able to breathe a little easier.

For investors, trying to predict the future of the stock market can be a daunting task, as market conditions can shift dramatically in a matter of days. However, one indicator that has been closely watched by experts is pointing in the direction of stability.

The Chicago Board Options Exchange (CBOE) Volatility Index, more commonly known as the VIX, is a measure of expected volatility in the markets. It is a widely accepted barometer of investor sentiment, with a high VIX signaling a more bearish outlook and a low VIX indicating a more bullish one.

Over the past year, the VIX has steadily declined. In fact, it has hit an all-time low in recent months, closing at 10.79 on April 9th. This indicator suggests that investors are expecting little to no volatility ahead, meaning a market crash is unlikely.

Furthermore, some economic data points also suggest that the markets are on firm ground. For instance, corporate earnings have been relatively strong, with the broad S&P 500 up 9.3% year-to-date. Unemployment is sitting at a historically low level of 3.5%, and consumer confidence is at an all-time high.

It’s also worth noting that while stocks have been on a tear this year, they have been relatively muted when compared to past bull markets. Indeed, the S&P 500 is up only 5% since the beginning of 2019, which is relatively low considering the index nearly doubled between 2013 and 2018.

With all of this information in mind, the chances of a market crash appear slim. Although it is impossible to predict the future with absolute certainty, the combination of low volatility and encouraging economic data suggest that investors should be able to breathe a little easier.