“The OPEC+ Summit: Will Oil Cuts Fuel Skepticism?

The oil industry has been in the news lately due to the skepticism surrounding the planned OPEC oil cuts. OPEC, the Organization of the Petroleum Exporting Countries, is an intergovernmental organization whose members include Kuwait, Saudi Arabia, Qatar, United Arab Emirates, Iraq, Algeria, Angola, Ecuador, Gabon, Iran, Libya, Nigeria, and Venezuela. These countries represent some of the largest oil producers in the world, controlling up to 70 percent of the world’s crude oil reserves between them.

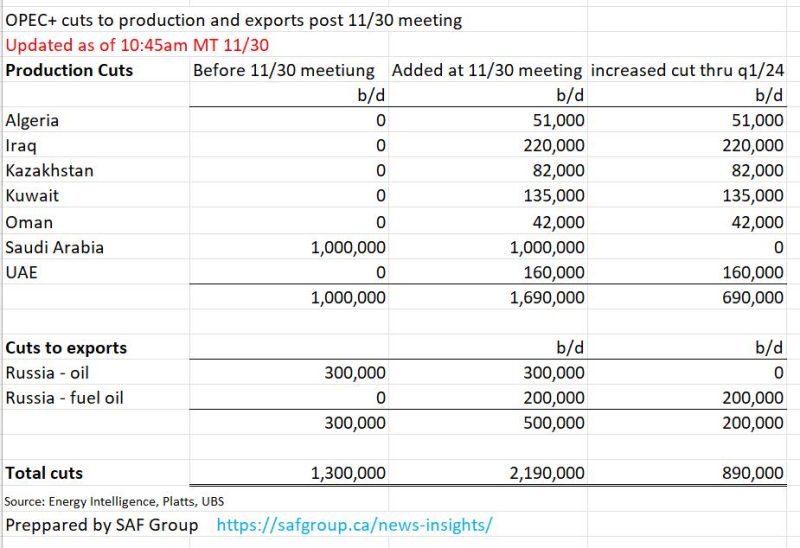

For a number of years, the OPEC nations have been trying to slow the production of oil in order to maintain a certain price level. The recent OPEC agreement to limit production by 1.2 million barrels per day, and 1.8 million barrels per day from non-OPEC countries, was seen as a sign of the industry’s willingness to collaborate in propping up the price of oil.

Despite this, however, there is still a lot of skepticism surrounding the extent to which the cuts will be implemented. There are fears that some of the countries involved in the deal are not as committed to it as they claim to be. It is no secret that some of the countries involved have had difficulties with compliance in the past, and it is feared that this lack of commitment could lead to some of the production cuts being short-lived.

Furthermore, it is widely believed that even if the production cuts are implemented as planned, they are unlikely to be enough to actually balance the market and increase prices significantly. This is because, while OPEC nations are reducing their output, other countries such as the United States, Russia, and Canada have either maintained or increased their production. As such, it is unclear whether the OPEC cuts alone will be enough to make a significant impact.

Given all this, it is not surprising that there is still a lot of skepticism surrounding the prospect of the planned OPEC oil cuts. It remains to be seen whether the cuts will be successful in propping up the price of oil, or whether they will simply be a short-term blip in an otherwise saturated market.

The oil industry has been in the news lately due to the skepticism surrounding the planned OPEC oil cuts. OPEC, the Organization of the Petroleum Exporting Countries, is an intergovernmental organization whose members include Kuwait, Saudi Arabia, Qatar, United Arab Emirates, Iraq, Algeria, Angola, Ecuador, Gabon, Iran, Libya, Nigeria, and Venezuela. These countries represent some of the largest oil producers in the world, controlling up to 70 percent of the world’s crude oil reserves between them.

For a number of years, the OPEC nations have been trying to slow the production of oil in order to maintain a certain price level. The recent OPEC agreement to limit production by 1.2 million barrels per day, and 1.8 million barrels per day from non-OPEC countries, was seen as a sign of the industry’s willingness to collaborate in propping up the price of oil.

Despite this, however, there is still a lot of skepticism surrounding the extent to which the cuts will be implemented. There are fears that some of the countries involved in the deal are not as committed to it as they claim to be. It is no secret that some of the countries involved have had difficulties with compliance in the past, and it is feared that this lack of commitment could lead to some of the production cuts being short-lived.

Furthermore, it is widely believed that even if the production cuts are implemented as planned, they are unlikely to be enough to actually balance the market and increase prices significantly. This is because, while OPEC nations are reducing their output, other countries such as the United States, Russia, and Canada have either maintained or increased their production. As such, it is unclear whether the OPEC cuts alone will be enough to make a significant impact.

Given all this, it is not surprising that there is still a lot of skepticism surrounding the prospect of the planned OPEC oil cuts. It remains to be seen whether the cuts will be successful in propping up the price of oil, or whether they will simply be a short-term blip in an otherwise saturated market.