“Time to Take a Step Back? Inter.-Term Participation Levels Overbought and Weak Long-Term

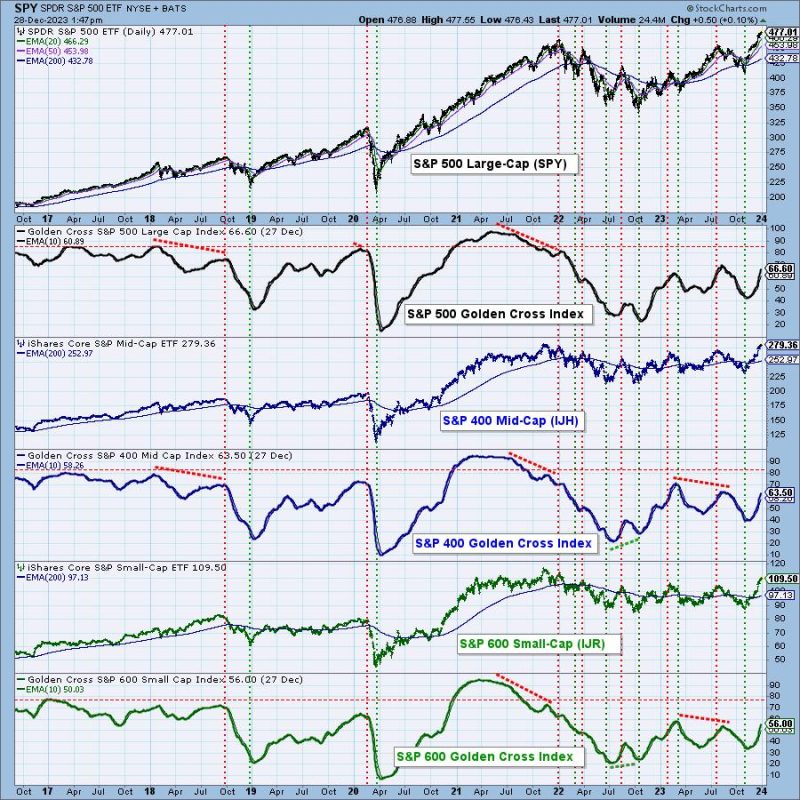

Intermediate-term participation levels are very overbought and they are weak long-term. An overbought market can be defined as a market with high levels of buying pressure, resulting in prices that rise faster than the underlying fundamentals. This is the case with the world’s major equity markets currently.

While these markets are currently very overbought in the intermediate term, the problem seems to be more pronounced when we look at the long-term view. While the markets are largely overbought, the participation rate of investors at these high levels has been surprisingly low. This indicates that investors are not as confident in the markets as they appear to be and that there may be some underlying weakness that is not currently being adequately reflected in the prices.

One of the key issues that may be driving investor caution is the fact that there are still significant risks in the global economy, including potential risks associated with US-China trade tensions, Brexit, and the European Union’s own economic problems. This causes investors to pull back from buying at the higher prices. This creates a self-fulfilling cycle of lower participation levels and lower prices, creating a weak underlying long-term investor sentiment.

Investors may also be wary as the current economic expansion has been running for a very long time and they may worry that a recession could be just around the corner. If this were to happen, then stocks could be in for a significant selloff. This could be further compounded by investors focusing on more defensive investments such as bonds or cash equivalents.

The conclusion that we can draw from all of this is that although the markets may be overbought in the short-term, investors appear to be unwilling to commit to these levels in the long-term. This is a worrying sign as it indicates that underlying investor sentiment is weak and that caution should be exercised when looking to invest in the current market environment. Investors should focus on stock selection rather than simply relying on passive investment strategies in order to take advantage of the current overbought conditions, while at the same time exercising due caution when investing in the long-term.

Intermediate-term participation levels are very overbought and they are weak long-term. An overbought market can be defined as a market with high levels of buying pressure, resulting in prices that rise faster than the underlying fundamentals. This is the case with the world’s major equity markets currently.

While these markets are currently very overbought in the intermediate term, the problem seems to be more pronounced when we look at the long-term view. While the markets are largely overbought, the participation rate of investors at these high levels has been surprisingly low. This indicates that investors are not as confident in the markets as they appear to be and that there may be some underlying weakness that is not currently being adequately reflected in the prices.

One of the key issues that may be driving investor caution is the fact that there are still significant risks in the global economy, including potential risks associated with US-China trade tensions, Brexit, and the European Union’s own economic problems. This causes investors to pull back from buying at the higher prices. This creates a self-fulfilling cycle of lower participation levels and lower prices, creating a weak underlying long-term investor sentiment.

Investors may also be wary as the current economic expansion has been running for a very long time and they may worry that a recession could be just around the corner. If this were to happen, then stocks could be in for a significant selloff. This could be further compounded by investors focusing on more defensive investments such as bonds or cash equivalents.

The conclusion that we can draw from all of this is that although the markets may be overbought in the short-term, investors appear to be unwilling to commit to these levels in the long-term. This is a worrying sign as it indicates that underlying investor sentiment is weak and that caution should be exercised when looking to invest in the current market environment. Investors should focus on stock selection rather than simply relying on passive investment strategies in order to take advantage of the current overbought conditions, while at the same time exercising due caution when investing in the long-term.