“Bitcoin Futures Interest Booms: Open Interest Skyrockets!

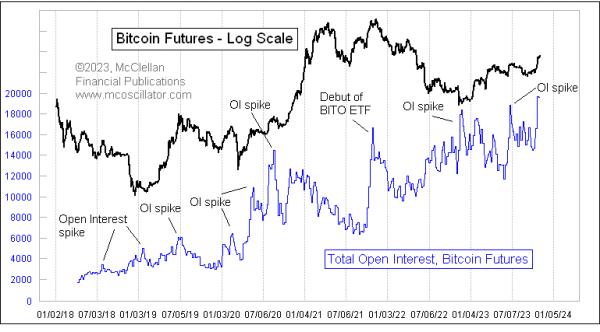

Bitcoin futures, a financial instrument for trading cryptocurrencies, have become increasingly popular in recent years. The market for them has grown exponentially over the past few months, with open interest (the number of outstanding contracts) reaching a new all-time high.

The rise in open interest is a sign of renewed confidence in Bitcoin futures, with investors keen to gain exposure to the asset without the risk of direct ownership. Not only do Bitcoin futures provide a relatively safe and convenient way of trading the volatile cryptocurrency but they also allow investors to speculate on its future value.

The surge in open interest suggests that traders are bullish on Bitcoin, predicting that its price will continue to rise. The recent spike is particularly encouraging, given that Bitcoin had endured a relatively weak start to the year – the result of a prolonged bear market in cryptocurrencies.

The increased demand for Bitcoin futures appears to be driven by institutional investors. Goldman Sachs, the world’s leading investment bank, recently announced that it was entering the market. Such moves indicate that the market is becoming increasingly mature, and could lead to further institutionalization of the sector.

Overall, the spike in open interest in Bitcoin futures is encouraging news for those hoping to gain exposure to the cryptocurrency. With institutional investors looking to get involved, the market is becoming increasingly mature and could become more widely accepted in the near future. Furthermore, the renewed confidence from retail traders suggests that the value of Bitcoin could continue to rise in time.

Bitcoin futures, a financial instrument for trading cryptocurrencies, have become increasingly popular in recent years. The market for them has grown exponentially over the past few months, with open interest (the number of outstanding contracts) reaching a new all-time high.

The rise in open interest is a sign of renewed confidence in Bitcoin futures, with investors keen to gain exposure to the asset without the risk of direct ownership. Not only do Bitcoin futures provide a relatively safe and convenient way of trading the volatile cryptocurrency but they also allow investors to speculate on its future value.

The surge in open interest suggests that traders are bullish on Bitcoin, predicting that its price will continue to rise. The recent spike is particularly encouraging, given that Bitcoin had endured a relatively weak start to the year – the result of a prolonged bear market in cryptocurrencies.

The increased demand for Bitcoin futures appears to be driven by institutional investors. Goldman Sachs, the world’s leading investment bank, recently announced that it was entering the market. Such moves indicate that the market is becoming increasingly mature, and could lead to further institutionalization of the sector.

Overall, the spike in open interest in Bitcoin futures is encouraging news for those hoping to gain exposure to the cryptocurrency. With institutional investors looking to get involved, the market is becoming increasingly mature and could become more widely accepted in the near future. Furthermore, the renewed confidence from retail traders suggests that the value of Bitcoin could continue to rise in time.